THE CALIFORNIA MANUFACTURING SECTOR STAYS ON A GROWTH PATH

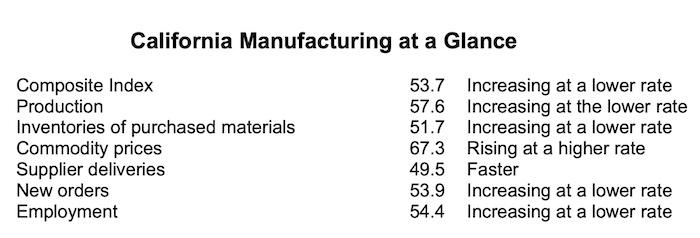

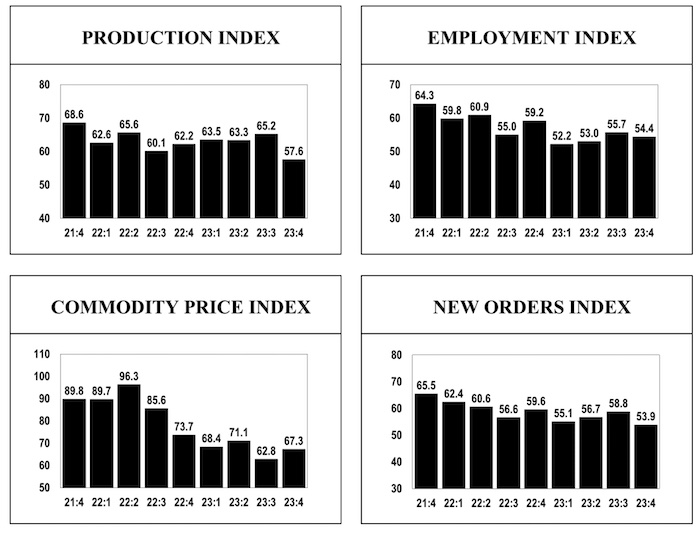

ORANGE, CA — Based on a survey of purchasing managers, the California Composite Index, measuring overall manufacturing activity in the state, decreased from 57.7 in the third quarter to 53.7 in the fourth quarter, indicating that the manufacturing sector is expected to grow at a lower rate in the fourth quarter. “Purchasing managers have noted that there is uncertainty in the near future regarding the performance of the economy. The word uncertainty was the most used word in the comments. They are in a “wait and see” mode as they put it. They fear that consumer spending will be mostly on necessities. Supplier deliveries continue to improve in many industries and backorders are being filled, they wrote. The WGA/SAG labor strikes are affecting some firms. Inflation and the high price level today compared to early 2022 are a major concern since they are affecting consumers’ choices,” said Dr. Raymond Sfeir, director of the purchasing managers’ survey. Production and new orders are expected to grow at a lower rate in the fourth quarter, and commodity prices are expected to rise at a higher rate. The high-tech industries are expected to grow at a lower rate and the non-durable goods industries are not expected to grow in the fourth quarter.

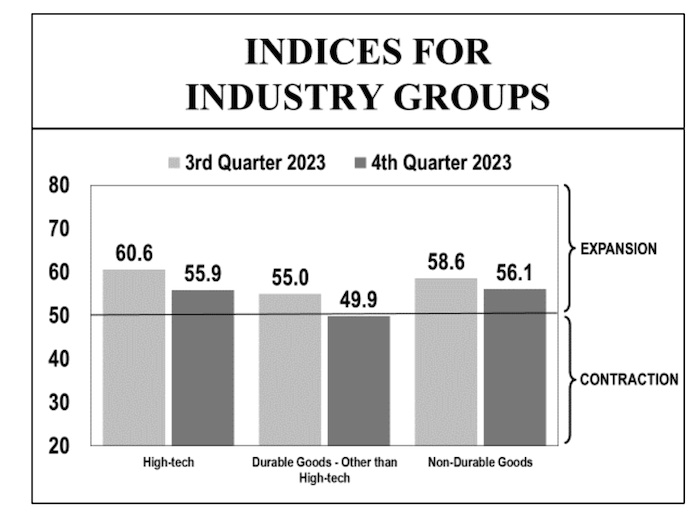

Performance by Industry Group

The index for the non-durable goods industries decreased from 58.6 in the third

quarter to 56.1 in the fourth quarter, indicating that these industries are expanding at a lower rate. Production is expected to grow at a lower rate as the index decreased from 67.0 to 58.0. Employment and commodity prices are expected to grow at a higher rate.

The high-tech industries include the following: Computer & Electronic Products, and Aerospace Products & Parts. The high-tech industries currently employ about 384,000 employees, amounting to 28.4% of total manufacturing employment in the state. The index for the high-tech industries decreased from 60.6 in the third quarter to 55.9 in the fourth quarter, indicating a lower growth rate in the fourth quarter. Production is expected to grow at a substantially lower rate as the index decreased from 70.3 to 60.3. New orders and employment are expected to grow at a lower rate. Commodity prices and inventories of purchased materials are expected to grow at a higher rate.

The index for the durable goods industries other than high-tech decreased from 55.0 in the third quarter to 49.9 in the fourth quarter, indicating practically no growth in the fourth quarter in these industries. Production, and new orders are expected to grow at a lower rate. New orders are expected to decline as the index decreased from 54.7 to 44.9. This is the first time the index dipped below 50 since the second quarter of 2020. Supplier deliveries are expected to be faster for the second consecutive quarter.

Comments by the Purchasing Managers

While there seems to be reasons for optimism, uncertainty in the near term regarding the national economy and multiple global issues, both political and supply chain related, are tempering expectations and most companies that we partner with are in a ‘wait and see’ mode. (Food)

Very seasonal packaged ice business. Very predictable quarter-to-quarter trends. (Beverage & Tobacco Products)

Reduction is raw material purchases, with production remaining steady due to efforts to reduce inventory approaching year end. (Textile Mill Products)

We don’t know if new orders will pick up, so we are operating more lean and mean, less excess inventory. (Apparel)

This is our busy time of our year. We are seeing supply chains lighten up. Our industry is still however in a recession. The box industry has been down since March or 2021. I expect a normalization of steadiness to begin between June through August next year. By that measurement that is a very long recession for this industry. This assumption is based on our government not messing things up more than they have and no out of the blue geopolitical instance. (Paper)

Increased fuel prices will impact our profitability due to fuel surcharges added to all invoices. (Printing & Related Support Activities)

The robust growth coming out of pandemic has continued to slow down. Supplier delivery time is improving. Employment continues to be an area of concern due to the lack of availability of skilled employees. (Chemicals)

The success of our business can be influenced by the Logistics of Supply Chain. Any delays which in essence create longer lead times will indeed impact our customer deliveries. World- Wide – Raw material shortages or controlled allocations in the Supply Chain would be any International Companies largest issue. (Plastics & Rubber Products)

Supply side shortages in hardwood lumber and hardwood veneer are prevalent. Sawmills reduced prices to move inventory but can’t afford replacement logs to make lumber. The timber owners are reluctant to reduce their stumpage rates for standing timber to replace kiln dried lumber being sold at lower prices. During the pandemic, demand was inelastic, prices didn’t matter but now that demand has slowed, we’ve become more elastic preferring to be out of stock to wait for better prices on replacement. (Wood Products)

Despite inflation pushing most prices up, we’ve already seen a slight fall in steel prices which are significant to us. We hope other prices will level off. We’ve built up some backlog, so we are ramping up production a little and found that laborers for hire are more abundant, but skilled professionals are still hard to find. (Nonmetallic Mineral Products)

With the Aluminum Extrusion Industry / Aerospace industry we are experiencing a very large demand for quotes and PO’s. We have a backlog with numbers that we have never seen before. Qualified workers are still an issue. The biggest effect for us is the number of employees we have that are qualified. Receiving raw material has not been an issue. (Primary Metals)

Inflation on commodities is still an issue. Employees’ pay rates continue to go up as the minimum wage goes up. Reaching limits on raising costs to our customers. (Fabricated Metal Products)

Supply chain issues overall are improving, however still seeing long lead times on equipment spare parts. Watching the UAW strike closely to see how this may impact employee perception of wage ‘fairness’. A significant increase may lead to other people feeling mistreated with typical 3%-6% increases (regardless of the background of UAW). (Machinery)

The US Government is NOT ordering at the same pace or volume as previous years. (Computer & Electronic Products)

Business seems to be stagnating. The prices are lower than COVID but customer sales are slowly picking up. (Electrical Equipment, Appliance & Components)

The election & weather. Too hot or too cold will slow sales. (Transportation Equipment)

The furniture industry continues to see a slowdown in business. Retailers are reporting lower sales than normal. Furniture is so intertwined with housing that it may stay this way until there are interest rate changes. (Furniture & Related Products)

We’re considering another rate increase due to gas prices that are on the rise again. Business demand has been good, but regulations and instability caused by our state and federal governments continue to hinder all businesses across the board. (Miscellaneous)

A major increase in orders and quotes is leading to a slowdown in manufacturing due to capacity constraints. (Aerospace Products & Parts)