THE MANUFACTURING SECTOR INCHES UPWARD

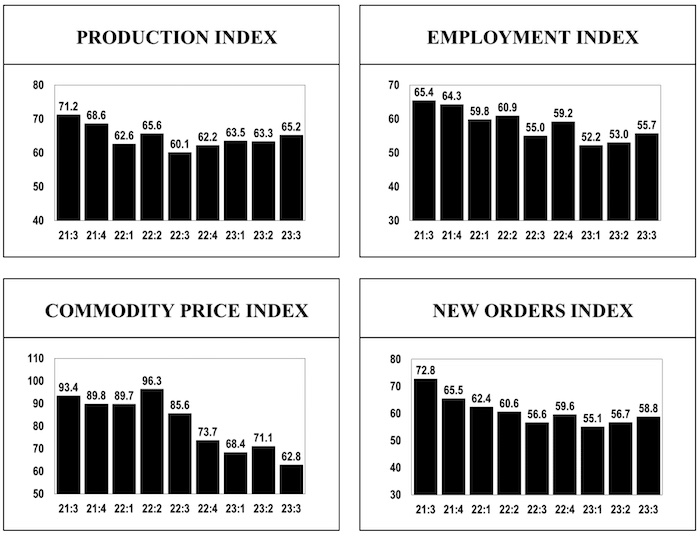

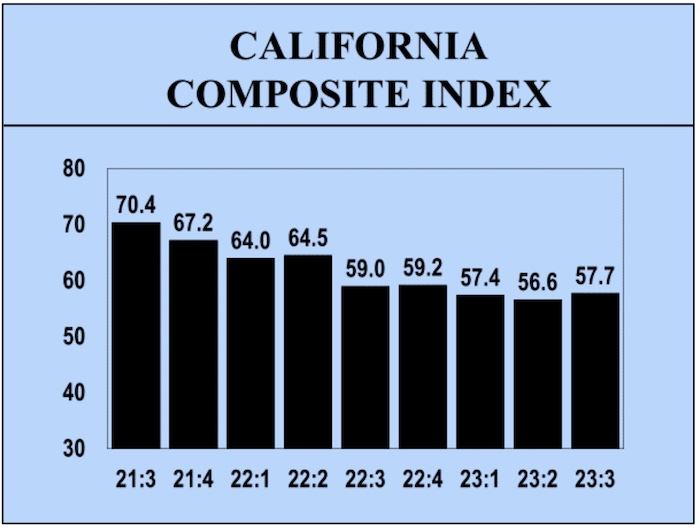

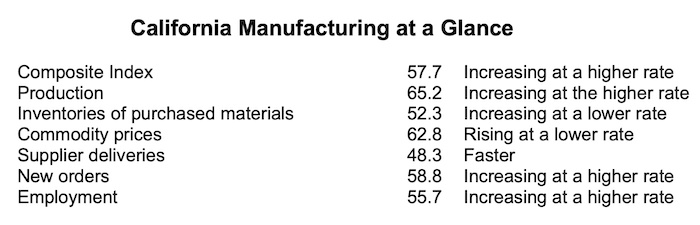

ORANGE, CA — Based on a survey of purchasing managers, the California Composite Index, measuring overall manufacturing activity in the state, increased from 56.6 in the second quarter to 57.7 in the third quarter, indicating that the manufacturing sector is expected to grow at a higher rate in the third quarter. “Purchasing managers have seen container pricing fall dramatically at the same time that a weaker Yen has helped with lower prices. They believe that the expiration of Chinese tariffs exemptions will hurt importers if not extended by the Biden administration and are concerned about the potential increase in interest rates. They have noticed that high end products are selling well while mid-level products are being substituted by lower quality goods,” said Dr. Raymond Sfeir, director of the purchasing managers’ survey. Production is expected to grow at a higher rate in the third quarter, and commodity prices are expected to rise at a lower rate, while supplier deliveries will be faster for the first time since the fourth quarter of 2016. New orders are expected to grow at a higher rate. The high-tech sector is expected to perform better than the rest of the manufacturing sectors, making up for its performance in the second quarter.

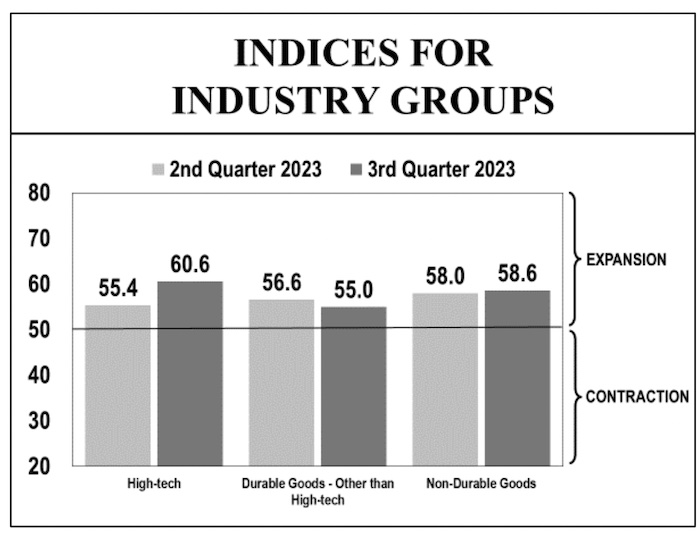

Performance by Industry Group

The index for the non-durable goods industries increased from 58.0 in the second quarter to 58.6 in the third quarter, indicating that these industries are expanding at a higher rate. Production and employment are expected to grow at a higher rate. Commodity prices are expected to rise at a much lower rate as the index decreased from 65.3 in the second quarter to 53.8 in the third quarter.

The high-tech industries include the following: Computer & Electronic Products, and Aerospace Products & Parts. The high-tech industries currently employ about 379,300 employees, amounting to 28.4% of total manufacturing employment in the state. The index for the high-tech industries increased from 55.4 in the second quarter to 60.6 in the third quarter, indicating a higher growth rate in the third quarter. Production is expected to grow at a substantially higher rate. New orders and employment are expected to grow at a higher rate. Commodity prices are expected to rise at a lower rate, and supplier deliveries are expected to be faster for the first time since the third quarter of 2016. Inventories of purchased materials are expected to grow at a lower rate.

The index for the durable goods industries other than high-tech decreased from 56.6 in the second quarter to 55.0 in the third quarter, indicating a lower growth rate in these industries. Production, commodity prices, and new orders are expected to grow at a lower rate. Supplier deliveries are expected to be faster for the first time since the third quarter of 2019. Employment is expected to grow at a higher rate.

Comments by the Purchasing Managers

Container pricing from overseas has fallen dramatically, helping to offset other price increases. Retail buyers of our consumer products, however, have cut back Holiday 2023 buying budget slightly, due to poor Easter Seasonal Sales this year. (Food)

The potential for port disruption on the west coast coupled with rail delays could have a crippling ripple effect throughout the supply chain. (Petroleum & Coal Products)

Inflation is still hurting growth over prior as consumers continue to spend less. (Textile Mill Products)

Short on material. Need faster response from suppliers. (Apparel)

We are seeing a bit of restocking in our clients and commitments towards retail display campaigns across various retailers especially big box stores. Some clients are still having supply issues from China and even quality issues. The next three months should prove that we have been burning through inventory, and restocking will occur as well as we will roll into holiday builds. This will not be as big as last year or the year before which were enormous which is why we have so much in the inventory stream. (Paper)

The paper shortage is starting to diminish so the need to hold high levels of inventory is lessening. This is also reducing the number of custom envelopes needed to produce and inventory for customers. (Printing & Related Support Activities)

Manufacturing is slowing, but distribution is still strong. We are pushing up margins and creating more structure to manage existing business and personnel and position ourselves to add high quality staff as our industry faces huge challenges with consolidation. (Chemicals)

Business is slowing, orders are getting pushed out. Prices increases have slowed but have not stopped. Labor continues to be an issue. Second half of the year will be slow. (Plastics & Rubber Products)

It would seem we are in neutral at this point in the year not much change. Interest rates still play a big part and can adversely affect the second half of this year. An increase negatively impacts future growth pushing a potential slowdown going forward. Supply availability and pricing have stabilized, demand remains the unknown. (Wood Products)

Prices are up across the board to keep up with inflation. Our production schedule currently shows some reduction, but that could change quickly since it is still the beginning of summer which is typically a busy season for construction. (Nonmetallic Mineral Products)

Not sure how much slower, but it seems things will slow down. (Primary Metals)

With interest rates rising we expected a downturn, but with the ERC money finally trickling in, many businesses are buying capital equipment. For us the economy is still being driven by stimulus money which was allocated years ago, and it is now just coming into the businesses and government agencies who are our customers. (Fabricated Metal Products)

Even though sales are expected to be down in Q3-2023, annual sales will exceed 2022. Prices continue to be elevated, especially for stainless steel and stainless steel components which make up 85% of the equipment our company manufactures. The economy, costs and finding qualified new hires remain the biggest challenges. (Machinery)

Semiconductor onshoring in the USA is creating a positive ripple effect throughout the entire supply chain, supporting growth, stability, and technological advancement in the country’s manufacturing sector. (Computer & Electronic Products)

Support goods and services lead times are improving as with many raw materials. Some metals and alloys (nickels and stainless steels) are available but with longer than normal lead times. (Electrical Equipment, Appliance & Components)

While the number of price increase announcements has decreased, increases are still occurring. Our largest supplier is having a 2% to 8% increase in zinc, ductile iron and brass, and other soft materials like buna, Teflon, etc. Price decreases have not shown up as we had hoped to see with inflation moderating, but instead price remain much higher than last year and are sticking. Freight is also another moderating cost, but still sticky in come down. While demand for our products remain good to moderate depending upon the product, we are encouraged for the future. (Transportation Equipment)

The furniture industry continues to see a lull in business…We continue to hear retailers complain about business conditions. Raw material prices have come down, suppliers are quicker to respond, employees are easier to find… all great things. (Furniture & Related Products)

Although we’ve seen a stabilization in prices and deliveries of raw materials we have noticed a slowdown in existing sales. We feel that even though inflation has calmed prices to consumers due to higher wages and material cost not receding, people are beginning to have to choose where and on what they spend their income on. (Miscellaneous)

Inflation is on the rise, but with a slower speed and momentum than the first quarter, therefore, expecting to have more orders and higher production. We are cautiously optimistic for the next two quarters. (Aerospace Products & Parts)