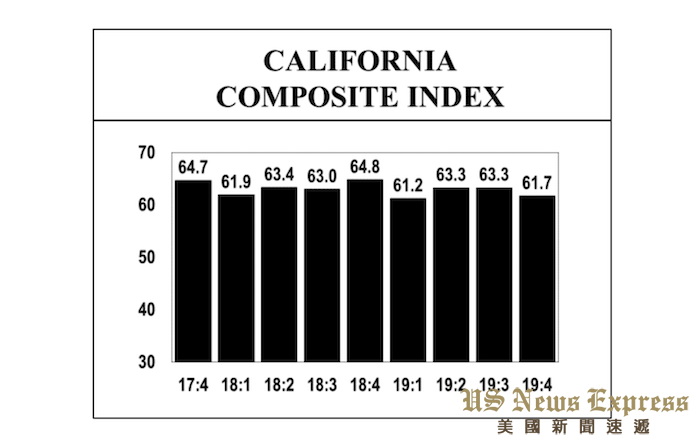

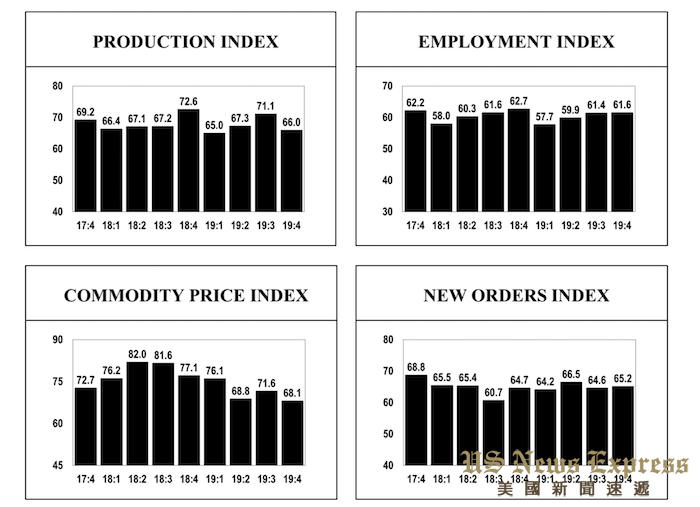

ORANGE, CA — Based on a survey of purchasing managers, the California Composite Index, measuring overall manufacturing activity in the state, decreased from 63.3 in the third quarter to 61.7 in the fourth quarter, indicating an expected lower growth rate in the fourth quarter. “The sustained growth in the California manufacturing economy is bucking a contraction in the national manufacturing sector observed in the last two months” said Dr. Raymond Sfeir, director of the purchasing managers’ survey. Manufacturing employment in California increased by 0.7 percent compared to July, while at the national level, it increased by only 0.02 percent. Production is expected to grow at a lower rate compared to the third quarter, but new orders and employment are expected to grow at a slightly higher rate.

Performance by Industry Group

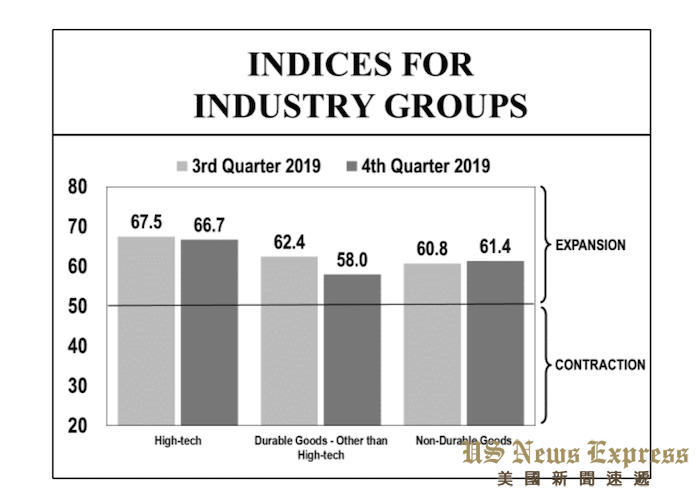

The index for the non-durable goods industries increased from 60.8 in the third

quarter to 61.4 in the fourth quarter, indicating a slightly higher rate of growth in the fourth quarter. Production is expected to grow at a lower rate, while new orders and employment are expected to grow at a higher rate compared to the third quarter.

The high-tech industries include the following: Computer & Electronic Products, and Aerospace Products & Parts. The high-tech industries currently employ about 371,700 employees, amounting to 27.4% of total manufacturing employment in the state. The index for the high-tech industries decreased from 67.5 in the third quarter to 66.7 in the fourth quarter, indicating a lower rate of growth. Production and inventories of purchased materials are expected to grow at a lower rate, while new orders and employment are expected to grow at a higher rate compared to the third quarter.

The index for the durable goods industries other than high-tech decreased from 62.4 in the third quarter to 58.0 in the fourth quarter, indicating a lower rate of growth in the fourth quarter. Production, new orders, and employment are expected to increase at a lower rate in the fourth quarter.

Comments by the Purchasing Managers

Cyclical business with peak sales in the fourth quarter, but imported fruit a trending industry headwind. (Food)

There is a lot more competition in our industry which is reason why our orders are either at par or below the last quarter. (Beverage & Tobacco)

Things seem to be holding steady unless new tariff increases are imposed yet again. Everybody seems to be taking a hit on this, suppliers, manufacturers and customers. Not necessarily a bad thing if it becomes more cost effective for manufacturing to grow here in the US. (Textile Mill Products)

We are a safety and apparel supply company that relies heavily on Chinese factories to supply the products we sell. No, it’s not China that is paying the tariffs! It’s import companies just like ours that pay. Of course, the question is do we pass it on to our customers? (Apparel)

American made product costs are increasing multiple times throughout the year – especially for paper & resin. These cost increases are hindering our clients from ordering product & implementing new programs which is slowing down everyone’s business. (Printing & Related Support Activities)

The Oil and Gas Industry is experiencing a slowdown due to regulatory backlog and new restrictions in California and Colorado. These will be negative determinants for the next two quarters at least and will lead to layoffs in the future if not arrested or accommodated. (Chemicals)

The lack of qualified employees and the general uncertainty in the economy continue to weigh on our business’ performance. (Plastics & Rubber Products)

The domestic steel market is adjusting down to realign with the world market, now that several trade actions are finalized. Domestic demand is now projected to trend down YOY through 2021. (Primary Metals)

I expect the price of steel and aluminum sheet to go up when they are being made in the USA. (Fabricated Metal Products)

Tariffs are causing some higher prices but overall, we are importing less product from China. The domestic products cost a little more but are available in less lead time. (Machinery)

Current tariff laws are really affecting pricing and lead times for materials as vendors try to move facilities to non-tariff countries. (Computer & Electronic Products)

Slowing production to reduce inventories, but slower customer sales/orders in China due to increased tariffs will negate any inventory savings. (Electrical Equipment, Appliance & Components)

The trade war and imposed Tariffs are having a significant negative impact on our sales and have increased our costs. (Transportation Equipment)

Finding and keeping employees for general labor is increasingly difficult and makes it difficult to increase production or increase sales that require manual labor. (Furniture & Related Products)

Custom Signage manufacturing is indeed fickle, and it seems seasonal as well. We are blessed to continue in the market place supplying signs and services for over 26 years. (Miscellaneous)

Increase in existing orders has leveled off. Raw material still seems to be an issue with lead times more than double from last year. (Aerospace Products & Parts)